フィリピンのデジタルウォレット市場研究報告書2025-2033

Market overview

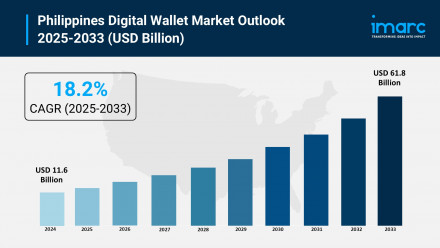

The Philippines digital wallet market is estimated to reach $11.6 billion in 2024 and $61.8 billion by 2033, with a CAGR of 18.2% . The digital wallet market is expected to expand during the forecast period from 2025 to 2033. Increasing smartphone penetration, increased internet access, and the expansion of e-commerce in the country are key growth factors. Collaboration between banks, telecommunications companies, and other stakeholders is also further accelerating market expansion. Government support through regulatory frameworks and national ID systems is also driving the widespread adoption of digital wallets.

How AI will change the future of the Philippine digital wallet market:

- AI-powered fraud detection tools can identify suspicious activity in real time, increasing security and consumer trust in digital payment systems.

- Advanced data analytics powered by AI will enable digital wallet providers to customize loyalty programs such as cashback offers and personalized discounts to increase user engagement.

- AI can enhance customer service through chatbots and voice assistants, simplify user interactions, and help bridge the digital literacy gap, especially in rural areas and among older populations.

- Integrating AI into credit scoring through transaction history analysis can help expand microfinance and credit services to underserved communities.

- The government’s adoption of AI-assisted cybersecurity protocols is in line with the Bangko Sentral ng Pilipinas’ regulatory framework and will ensure safer transactions.

- AI will enable seamless cross-platform transactions and integrated QR code systems to support interoperability and address fragmented payment infrastructure.

Get a sample PDF of this report: https://www.imarcgroup.com/philippines-digital-wallet-market/requestsample

Market growth factors

The widespread adoption of smartphones and improving internet infrastructure are key growth factors in the Philippines' digital wallet market. The number of mobile subscribers is expected to reach 159 million, while the number of broadband subscribers is expected to reach approximately 10.8 million, facilitating widespread access to digital wallets. These technologies enable convenient financial transactions for residents in urban and remote areas, contributing to greater financial inclusion. Furthermore, digital wallets offer low transaction fees and rewards such as cashback, making them a cost-effective alternative to traditional banking for small-value transactions, contributing to an increase in their user base.

In the Philippines, a booming e-commerce industry is driving significant demand for digital wallets. With the e-commerce market estimated to reach US$24 billion, consumers value the convenience of digital wallets as a secure and fast way to make online payments. The integration of wallet payment options into online retail platforms and enhanced security features such as two-factor authentication are mitigating fraud risks and boosting consumer confidence. These trends are driving increased adoption of digital wallets by online shoppers, making them a trusted payment method in the growing digital economy.

Partnerships between banks, fintech companies, and local businesses have promoted financial inclusion by targeting unbanked and underbanked communities. Digital wallets enable basic transactions such as payments and remittances without the need for a traditional bank account. The expansion of contactless payment infrastructure (NFC terminals and QR code systems) is facilitating adoption by offering a fast, safe, and hygienic alternative to cash. Furthermore, government efforts to promote digital payment adoption and integrate loyalty programs are increasing consumer retention, encouraging repeat business, and fostering sustained market growth.

Market Segmentation

Type Insight:

- Proximity

- Remote

Deployment type insights:

- On-Premises

- cloud

Industry vertical analysis:

- education

- game

- Information Technology and Communications

- Aerospace and Defense

- Legal

- Media and Entertainment

- car

- Banking and Financial Services and Insurance

- consumer goods

- others

Regional Insights:

- Luzon

- Visayan Islands

- Mindanao

Key Players

- GCash

- Toons

- Philippine Airlines (PAL)

- Asia United Bank (AUB)

- Globe Telecom

Recent Developments & News

- August 2025: The Philippine government partnered with GCash, a leading e-wallet provider, to introduce cashless payment options on the Metro Rail Transit System Line 3 (MRT-3). The initiative enhances the commuter experience by integrating advanced financial technology into one of Metro Manila's busiest transit systems.

- April 2025: Philippine Airlines (PAL) introduces its own e-wallet, streamlining rewards management for travelers by consolidating multiple digital cards, including travel credits and e-gift cards, into one convenient account.

- November 2024: Thunes partners with GCash to enable direct top-up of wallets from UK and European bank accounts. This collaboration enables real-time, cost-effective cross-border top-ups, improving convenience and financial control for GCash users overseas.

Note: If you require specific information that is not currently included in the scope of the report, provide it as part of your customization.

Request a customized sample report from our analysts: https://www.imarcgroup.com/request?type=report&id=23574&flag=C

About Us

IMARC Group is a global management consulting firm that supports the world's most ambitious change-makers to create lasting impact. We offer comprehensive market entry and expansion services. IMARC's services include in-depth market assessments, feasibility studies, company formation assistance, factory formation assistance, regulatory approval and licensing assistance, branding, marketing and sales strategies, competitive landscape and benchmark analysis, pricing and cost studies, and procurement studies.

inquiry

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel: (D) +91 120 433 0800,

USA: +1-201971-6302